Stop recipes: Cryptocurrency Investors Final Protection

The cryptocurrency world is known for its high risk and high reward. Because the value of cryptocurrencies such as Bitcoin and Ethereum is constantly fluctuating, investors often wonder how to protect their investments against market volatility. An effective way to keep your wallet is to stop teams. In this article, we will study the interruption orders how they work and why they are needed for cryptocurrency investors.

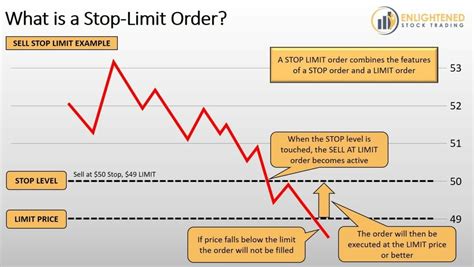

What is a stop order?

The stop order is an electronic instruction for a brokerage company or a conversation platform to sell or purchase a specific warranty on the current market price if it falls below this level. Simply put, the suspension order is the “Stop-Loss” order that prevents you from losing money for your investment if its value decreases.

For example, let’s buy $ 100 Bitcoin for $ 10,000 with a exchange rate of $ 1 BTC = $ 10,000. If the price drops to $ 999, your suspension order will make your broker sell your Bitcoin at this price by blocking the profit. Conversely, if the price exceeds $ 11,000, your broker realizes your Bitcoin at this higher price, preventing you from selling and losing potential benefits.

How to stop teams running?

STOP orders are usually determined by investors with special purposes, such as:

- Market protection : Defined in the suspension order below current prices, you can prevent significant losses if the market receives a blow.

- Speculation on Price Movements : You can use interruption orders to buy or sell at certain prices to benefit from short -term price fluctuations.

3

Fulfillment of Strategy : Stop orders can be used as “buy” or “sell” the trigger for a specific investment, allowing you to quickly meet changing market conditions.

To define a suspension order in exchange, you will usually need:

- Brokerage account

- Trade Platform (eg RobinHood, Coinbase)

- The cryptocurrency you want to exchange

The process is to define the following information:

* Stop price : Current market price or fixed threshold (eg $ 10,000).

* Loss loss size : The amount of profit (or loss) you are ready to take with you if the price is stopped.

- Time Power (TIF): The speed you want your order to stop executing.

For example:

- Stop Control: Purchase 100 BTC for $ 999 with 1%loss.

- Time: Immediate or open (io / o)

Why is stopping orders needed for cryptocurrency investors?

While market volatility may seem controversial intuitive to define stop orders, they offer many benefits:

- Protection against price reduction : By setting a suspension order below current prices, you can protect your contribution and avoid significant losses.

- Risk Management : Stop orders help you manage risks by limiting potential losses when market slowdown or unexpected price movements.

3

Flexibility : You can adjust your suspension size to adjust to your individual trading strategy.

- Reducing the Emotional Decision -Adoption

: When defining the suspension procedure, you are less likely to make impulsive decisions based on emotions.

Conclusion

Stopping orders is an effective way to protect your cryptocurrency investments from market volatility. Understanding how they work and why they are needed for investors, you can take control of your portfolio and make more informed decisions on negotiations. Regardless of whether you are an experienced investor or just start, the interruption order integration into your strategy can help with confidence to navigate the cryptocurrency world.

Additional resources

If you are a new cryptocurrency investment or if you want to know more about stopping orders, consider the following resources:

* RobinHood Stop Team Guide : Full Guide for RobinHood Defining Order Definition and Management.

بدون دیدگاه